5 Signs a Condo Project Is a Strong Investment

Real estate investing isn’t about luck, it’s about recognizing the right opportunities before they become obvious. When it comes to pre-construction condos, the best investors know how to identify a project with strong fundamentals that point toward long-term profitability and capital growth. But how can you tell if a condo project is actually a good investment, or just marketing hype?

In this article, we’ll break down the 5 signs a condo project is a strong investment, backed by data, trends, and real-world examples. Whether you’re a seasoned investor, a foreign buyer, or a high-net-worth individual looking to diversify into real estate, these are the markers that should give you confidence.

1. Prime Location With Future Growth Drivers

Location is still king, but not just any location.

A strong condo investment isn’t necessarily in the heart of downtown; often, the best opportunities are in up-and-coming neighborhoods with clear signs of future development: transit expansions, new commercial zones, infrastructure spending, or large institutional investments (like hospitals or universities).

What to look for:

- Planned transit hubs (e.g. Metrorail and Brightline)

- New corporate headquarters, campuses, or tech hubs nearby

- Walkability to amenities, even if they’re still in development

- Gentrifying neighborhoods with improving demographics

Example: Projects near Miami’s Brightline stations are attracting investor attention for good reason. These aren’t just condos, they’re future-proofed growth plays.

501 First by Aria Development Group 🔗

2. A Reputable Developer With a Track Record

One of the clearest signs a condo project is a strong investment is the developer behind it.

Fly-by-night builders can delay, cancel, or deliver low-quality units, hurting your ROI. On the other hand, developers with a history of delivering on time, on budget, and with high resale value provide confidence.

What to look for:

- Completed buildings you can tour or research

- Consistent on-time delivery history

- Transparent contracts and upgrade pricing

- Awards, industry recognition, or repeat investor followings

Tip: Search reviews from owners in the developer’s past buildings. Poor finishing quality or management issues often show up there first.

3. Strong End-User Demand and Rental Appeal

Is there demand for people to live in the building? That’s key.

Whether you’re flipping, renting, or holding, the value of your unit depends on what someone is willing to pay — either to buy or to live there. That’s why you need to assess the real end-user demand in the area and the type of units being offered.

What to look for:

- Small units in cities with high immigration or student populations

- 2-bedroom units near employment hubs or hospitals

- Walk scores above 85 and transit scores above 90

- Low future supply (few competitors breaking ground nearby)

Bonus: If the project is in a short-term rental-friendly zone, such as parts of Miami, you might have even more income upside.

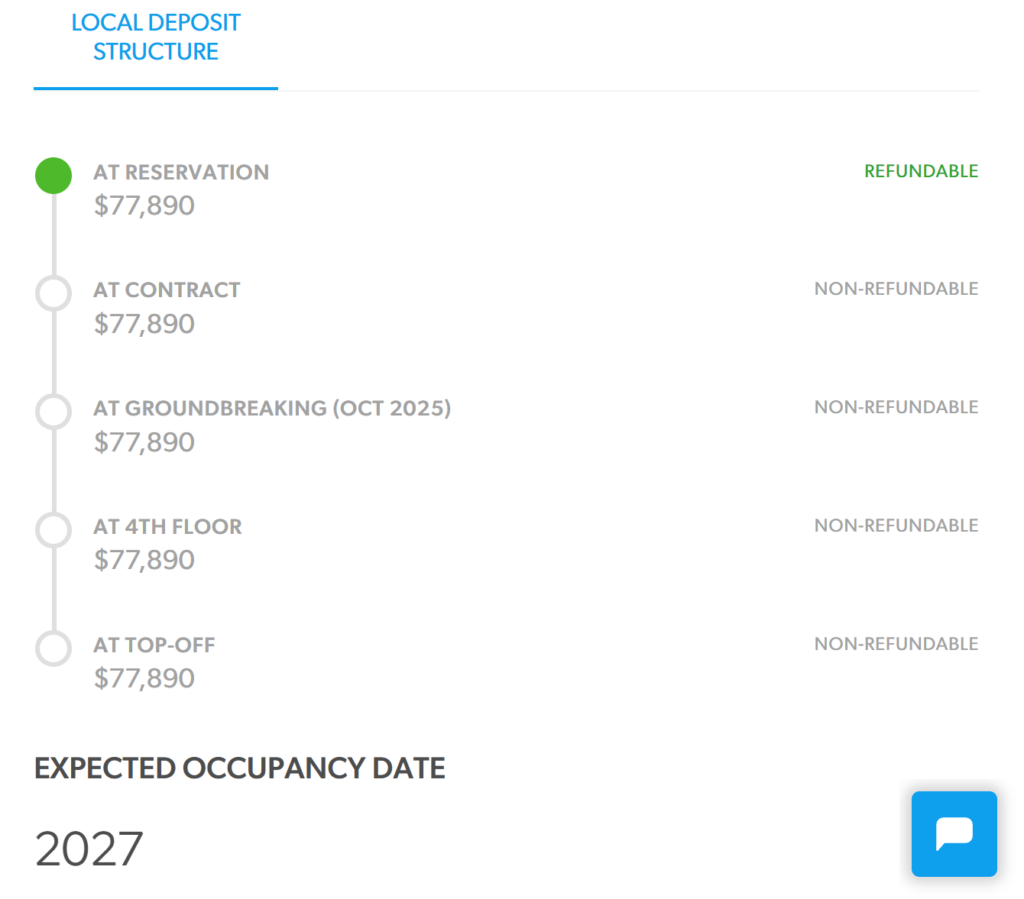

4. Investor-Friendly Deposit Structures and Incentives

The numbers have to make sense.

Projects that are investor-savvy often offer flexible deposit structures, capped closing costs, rental guarantees, and assignment rights. These terms can significantly improve your ROI and reduce risk.

What to look for:

- 15–20% deposits spread over 12–24 months

- Right to assign (especially without a fee)

- Cap on development charges or levies

- Free or discounted parking/locker incentives

Example: Some projects offer rental guarantees for 1–2 years, meaning you can estimate your returns more confidently in the early ownership period.

5. Favorable Market Timing and Macroeconomic Signals

Finally, even the best project can be a bad buy if you buy at the wrong time.

Look for signs that the broader condo market is entering a value phase, lower pre-construction pricing, rising resale prices, immigration increases, or declining new housing starts. Smart investors buy when there’s less hype and more fundamentals.

What to look for:

- Incentives that suggest developers are competing (a buyer’s market)

- Strong population or employment growth in the area

- Government housing targets not being met (future supply shortage)

- Interest rate signals pointing to future cuts

Right now in cities like Toronto, Miami, and Vancouver, buyer incentives and increased immigration are converging — creating real opportunity.

Know the Signs, Make the Right Move

There’s no such thing as a “sure thing” in real estate, but there are clear patterns and signals that can help you stack the odds in your favor. If you’re seeing these 5 signs a condo project is a strong investment, it may be worth making your move before the rest of the market catches on.

Whether you’re a first-time investor or a seasoned buyer looking for portfolio growth, don’t rely on gut feeling alone, rely on strategy.

Ready to invest in the right project?

📞 Book a discovery call with our team 🔗

🏡 Browse our curated Florida listings 🔗