Why Does Evaluation Matter More Than Hype

If you’ve been browsing glossy brochures, visiting sales centers, or scrolling through renderings of luxury towers, you’re not alone. The pre-construction condo market in cities like Toronto, Miami, and Vancouver is booming, and with good reason. For investors, foreign buyers, and relocating professionals, these deals offer early access pricing, flexible payment structures, and long-term upside.

But here’s the catch: not all pre-construction deals are created equal.

So, how do you evaluate a pre-construction condo deal before you commit to a five- or six-figure investment?

This step-by-step guide will walk you through how to make smart, informed, and financially sound decisions. Whether you’re purchasing for rental income, resale appreciation, or future personal use, these principles apply.

Step 1: Know Your Investment Goals

Before you even look at a floorplan or price list, get clear on your “why.”

Are you:

- Investing for long-term appreciation?

- Looking for strong rental cash flow?

- Buying a future residence while working abroad?

Your goal will shape what “good deal” means. A high-net-worth investor might focus on exclusive penthouse units with long-term prestige, while a foreign buyer might prioritize builder reputation and legal protections.

Step 2: Evaluate the Location Like a Developer

The old real estate saying still holds: location is everything.

But don’t just look at current maps, look at the future.

Ask yourself:

- Is the area growing in population and infrastructure?

- Are there upcoming transit projects, schools, or business hubs nearby?

- What does the surrounding resale market look like?

Example: A condo near a future transit line (like Toronto’s Ontario Line or Miami’s Brightline expansion) could see price jumps before occupancy even begins.

Bonus tip: Tools like Walk Score, Transit Score, and pre-zoning maps can help.

Step 3: Research the Developer’s Track Record

One of the most overlooked steps in how to evaluate a pre-construction condo deal is researching the builder’s history.

Check:

- Have they delivered past projects on time?

- Did those projects match the advertised finishes and quality?

- Do they have complaints filed or lawsuits?

Reputable developers often offer early incentives, better assignment terms, and smoother handovers. Don’t settle for big marketing—dig into their past work.

Step 4: Understand the Pricing and Incentives

Many buyers ask, “Am I getting a good deal?” But the better question is: “Am I getting the right value at this stage of the release?”

Key things to review:

- Price per square foot compared to surrounding resale and other new builds

- Whether you’re buying at VIP pricing (early release) or after multiple price hikes

- Included incentives, such as free parking, locker, upgrades, or capped development levies

Example: Paying $1,400/sq ft in downtown Toronto might seem high—unless the resale comps are already trading at $1,500/sq ft and your project delivers in 3 years.

Step 5: Scrutinize the Floorplan and Layout

Don’t be fooled by square footage alone. Efficiency matters more.

Ask:

- Is the layout functional (no wasted hallway space)?

- Do rooms have proper windows and proportions?

- Is the living area wide enough for real furniture?

A 600 sq. ft. unit with smart design can outperform a 700 sq. ft. unit with dead space in terms of livability and rentability.

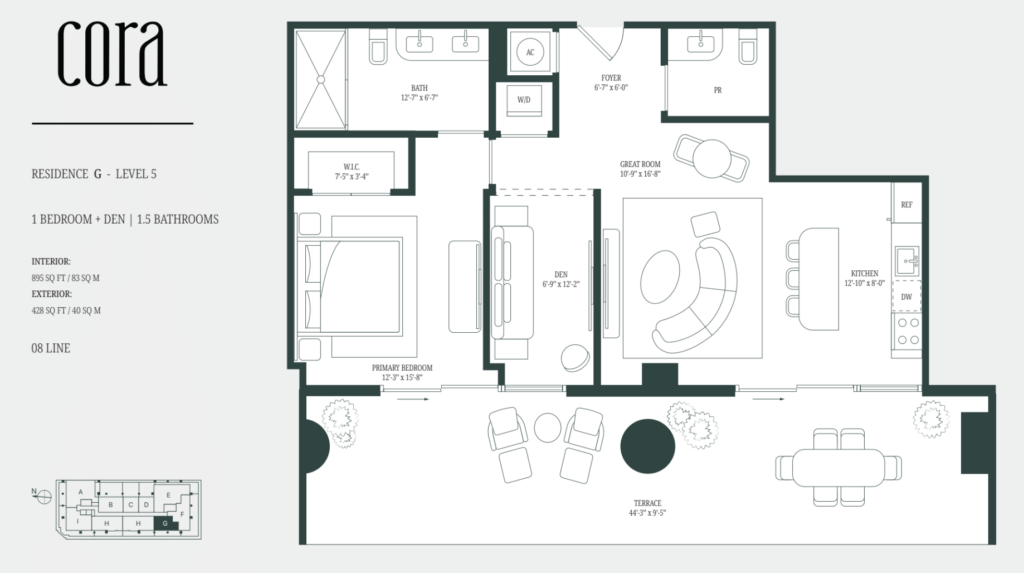

🔗 Visit Cora on CondosGlobal.com 🔗

Step 6: Assess the Deposit Structure and Financial Terms

Pre-construction condos require staged payments, often totaling 15–25% before occupancy.

Make sure you understand:

- Deposit schedule (e.g., 5% at signing, 5% in 90 days, etc.)

- Final closing costs (land transfer tax, legal fees, HST if applicable)

- Development charges and how they’re capped

- Assignment clause flexibility (can you resell before closing?)

Foreign buyers may face different terms, so confirm what applies to your situation.

Step 7: Evaluate the Project Timeline

Every month of delay eats into your expected ROI, especially if you’re counting on future rent or appreciation.

Check:

- Estimated occupancy date vs. industry average build time

- Builder’s reputation for on-time delivery

- Flexibility in your own financing or plans if the project runs late

Be cautious of overly aggressive timelines unless backed by past performance.

Step 8: Run the Numbers: Cash Flow, Appreciation, ROI

Here’s where investors set themselves apart.

Create two models:

- Cash flow model: Based on projected rents, condo fees, taxes, and financing

- Appreciation model: Based on historical market growth and conservative resale projections

Ask your agent or broker to provide a pro forma spreadsheet. Smart investors run multiple scenarios: best case, realistic case, and worst case.

Example: A $700,000 unit that rents for $3,000/month may appear break-even until you factor in condo fees, property tax, and vacancy risk.

Step 9: Review Legal Documents (Don’t Skip This)

Before signing, have your real estate lawyer review:

- Agreement of Purchase and Sale

- Disclosure Statement

- Any developer addendums or upgrades list

This is where hidden clauses often live, like changes to square footage, allowed substitutions, or surprise fees.

If you’re a foreign buyer, legal review becomes even more important due to tax implications and mortgage rules.

Step 10: Consider the Exit Strategy

A smart investor always looks at the exit.

Ask:

- Can I assign the unit if I change plans before occupancy?

- What is the likely resale demand for this layout and location?

- Will this unit appeal to long-term renters, end-users, or other investors?

If you’re buying in a saturated market with 10 similar units per floor, resale competition could impact returns.

Bonus: Work With a Pre-Construction Specialist

When learning how to evaluate a pre-construction condo deal, guidance matters. The right realtor can provide:

- Early VIP access to inventory

- Objective analysis on developer track records

- Help negotiating fees, upgrades, and assignment rights

- Coordination with legal and financial teams

Best of all? The builder usually pays the buyer agent’s commission—so there’s no cost to you.

Conclusion: The Deal Is in the Details

Evaluating a pre-construction condo deal isn’t about chasing hype or relying on salespeople. It’s about doing your due diligence, crunching the numbers, and understanding what you’re truly buying—on paper, in legal terms, and in future market potential.

If you’re a real estate investor, foreign buyer, or relocating professional looking to make a smart purchase, don’t go it alone.

✅ Let’s Talk About Your Investment Goals

At Condos Global, we specialize in helping buyers evaluate pre-construction condo deals with precision. From Toronto to Miami, we have the data, access, and experience to help you succeed.

📞 Book a strategy call today🔗

🔍 Browse upcoming VIP launches and floorplans 🔗

💼 Get help reviewing deals, contracts, and market insights 🔗